Become a Part of Powerful Real Estate Opportunities

Explore high-growth assisted living real estate and potential Opportunity Zone tax benefits

About Us

Emerald Park OZ Funds invests in Qualified Opportunity Zone (QOZ) projects and supports investors through every stage of the investment lifecycle. We identify and structure eligible Opportunity Zone investments to align with the goals of high-net-worth individuals, corporations, and asset managers. Where investors receive full support; from initial project selection and tax optimization strategies to compliance guidance and planned exit execution; designed to maximize both financial returns and long-term tax advantages.

Potential Tax Benefits

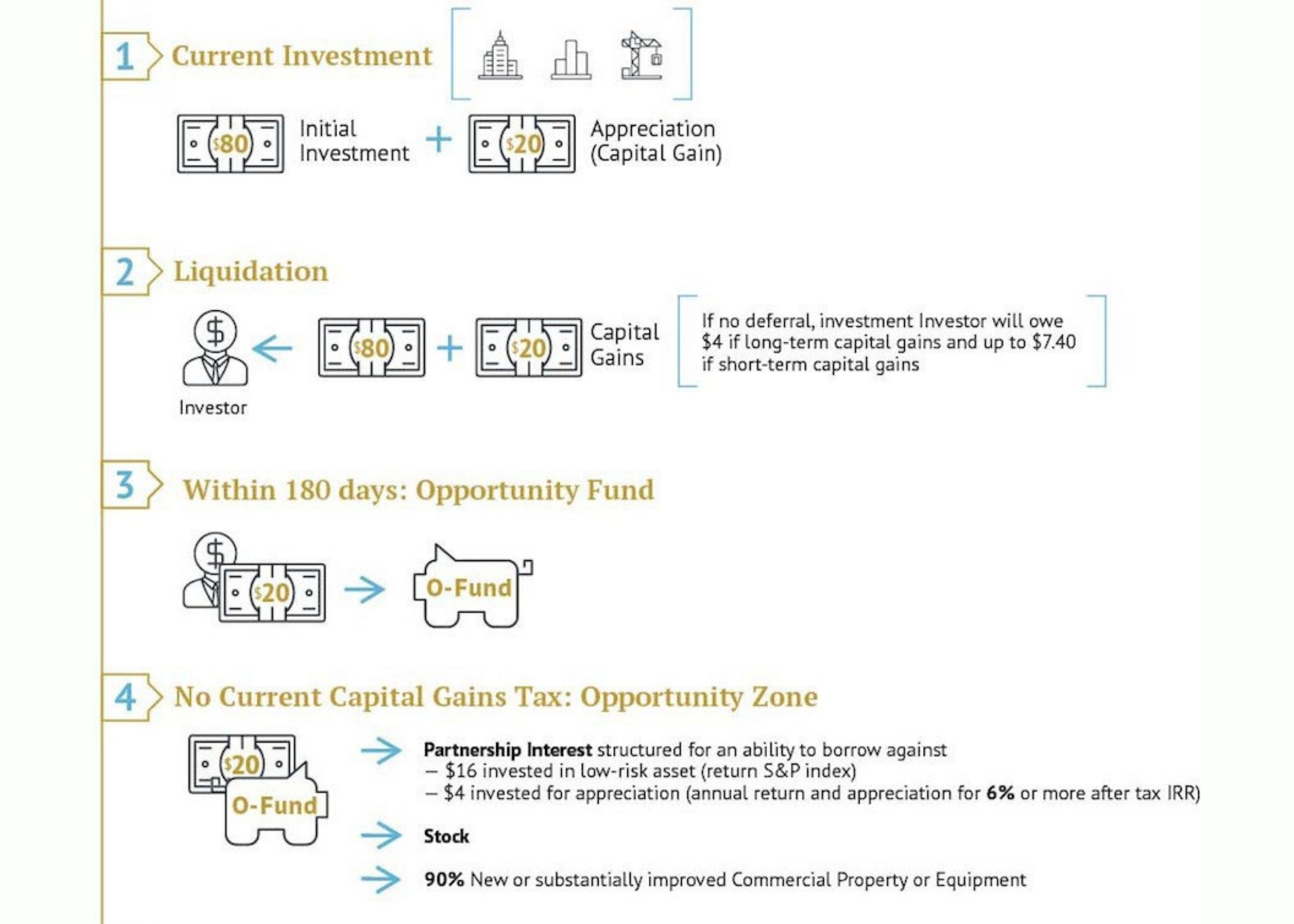

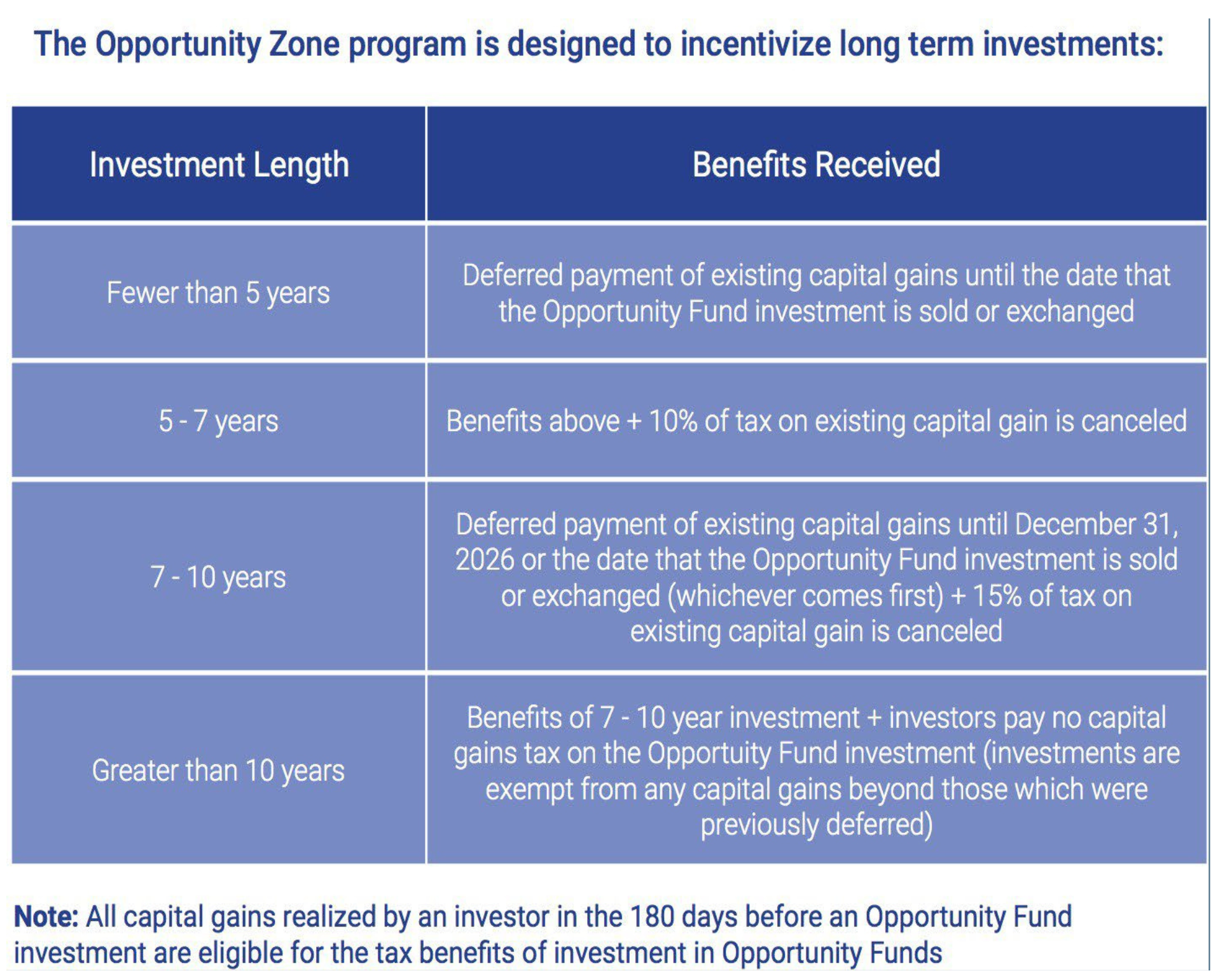

How Does It Work?

Qualifying OZ Investments

Who Can Benefit?

Any taxpayer who realizes capital gains and wishes to defer the U.S. tax on those gains. Subject to certain restrictions, capital gains can be deferred and reduced by investing the gains in QOZs property.

What’s the Catch?

To defer gains, the taxpayer must invest the gains in a QOZ within 180 days of a realization event either by purchasing stock or partnership interests in businesses physically located in qualified zones.

What Counts as QOZ?

To qualify for QOZ deferral, the taxable gains must result from the sale of the property to an unrelated party. “Related” parties are narrowly defined to include lineal descendants and members of controlled business groups.

Qualifying Opportunity Zone Project

What is an Opportunity Zone?

Basic Outline of The Program

- First, an investor sells an existing appreciated asset.

- Second, the investor invests the gain portion of the sale proceeds into a Qualified Opportunity Fund (“QOF”) within 180 days.

- TAX BENEFIT #1 – The investor defers the entire amount of the gain that is reinvested into the QOF.

- Third, the investor pays tax on the deferred gain at the earlier of (i) the sale of its interest in the QOF, or (ii) December 31, 2026.

- TAX BENEFIT #2 – If the investor has held its QOF investment for at least 5 years, 10% of the deferred gain is permanently forgiven. If the investor holds its QOF investment for at least 7 years, an additional 5% (for a total of 15%) of the deferred gain is permanently forgiven. (Note that to get the 7 year benefit, an investor must invest in a QOF no later than December 31, 2019.)

- Fourth, the investor sells its interest in the QOF at exit.

- TAX BENEFIT #3 – If the investor holds its QOF investment for at least 10 years, there is no tax at all on the gain realized by the investor at exit.

Long Term Investment Benefits

Assisted Living

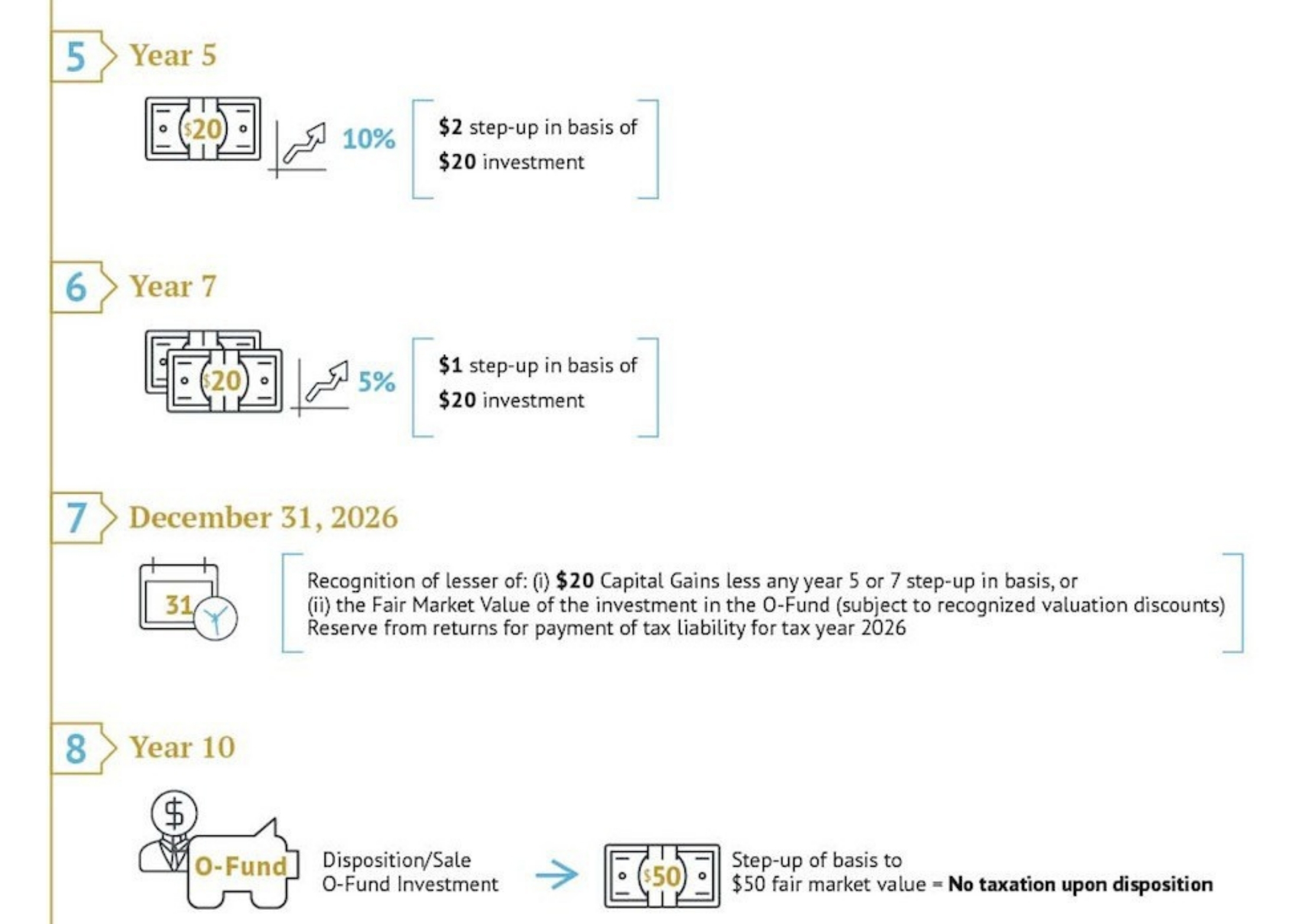

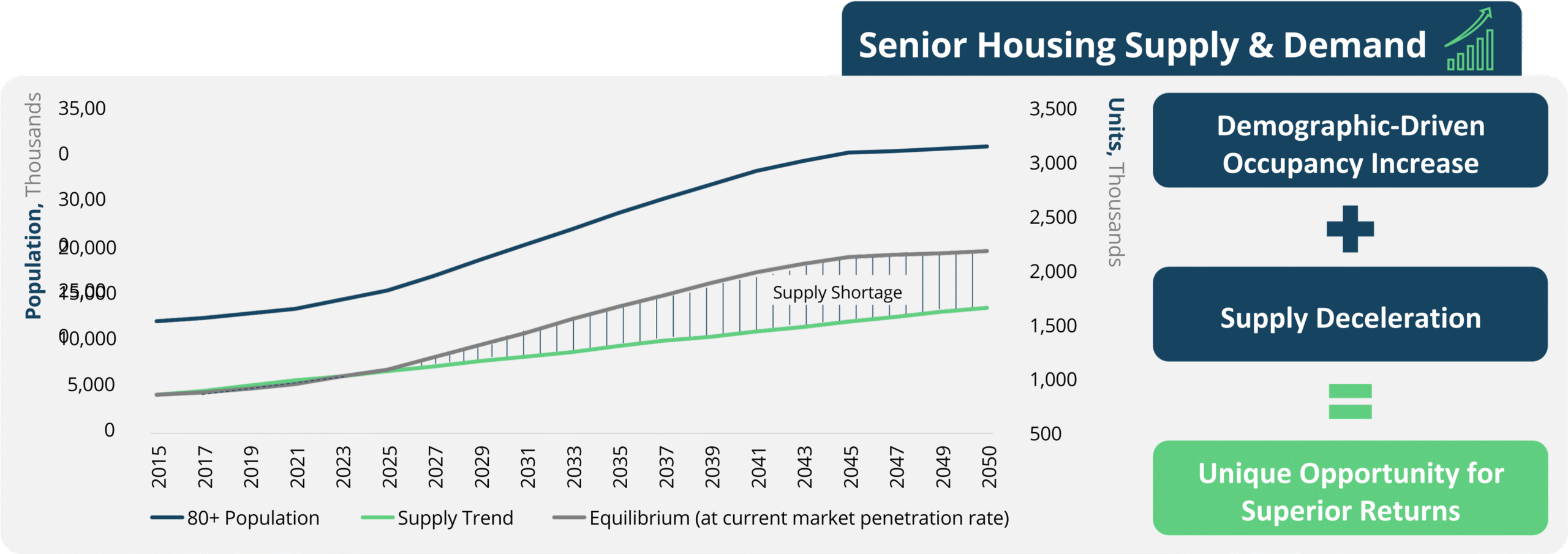

The Senior Living Thesis Has Never Been Stronger

- Improving Population Demographics

Rapidly aging national population driving long-term demand for senior living

- Leading Asset Type for Rent Growth in 2024

Senior living leads all major CRE asset types in average rent growth at +3.8%, exceeding multifamily +1.1%, retail

+2.2%, and industrial +2.9%

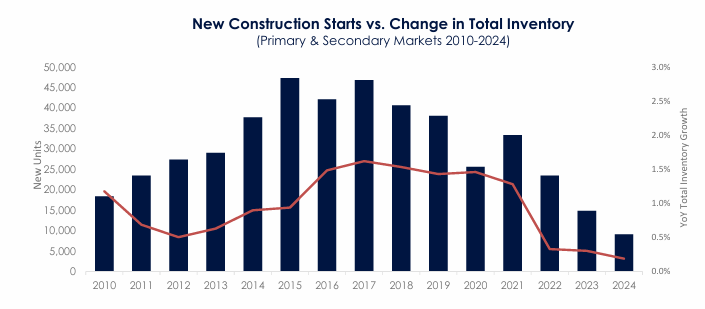

- Limited Supply, Unlikely to Keep up with Impending Market Demand

Population growth of 80+ year olds has exceeded inventory growth for two consecutive years leading to 90%+

occupancy rates, and is projected to materially pick up momentum over the next decade

- Highly Liquid Marketplace

Excess of available equity, REITs raising capital for new funds exceeding $1B+

- Recession Resilient Asset Class

Insulated by inelastic demand and minimal fundamental erosion through recessionary periods, resident base requires

hands-on care that can only be performed in-person, in-facility regardless of economic climate

The Nation's Aging Population Serves as a key Demand Driver

Senior Living and Care Remains a Supply Constrained Market

The population of senior citizens in the U.S. is estimated to grow 35% through 2040, increasing by an incredible 20.5 million individuals. With senior living new construction starts at a 15-year low following 9 years of decline, the market is not positioned to meet impending demand with sufficient new supply setting the stage for material vacancy rate compression and exceptional revenue growth.

Testimonials